Expense Management

Automating weeks of manual work for corporate card admins and simplifying card users’ expense process

Overview

Capital One Commercial Card Platform allows card program administrators to manage their corporate card transactions, credit limit, and expenses. Cardholders have a mobile experience which allows them the view transactions, receive notifications, and lock their card in case of fraudulent charges.

MY ROLE

I was the Lead Designer partnering with two product managers and tech leads on the respective mobile and web teams for Commercial Card Plastics. I Led in-person and remote research sessions with select clients, completed wireframes and UI/UX design. I collaborated tech teams on grooming stories for development, and reviewed in-progress work through to feature release.

The problem with corporate expense management…

Companies with corporate card programs almost always need to collect expense metadata from their cardholders for tax purposes. This is either done through a time consuming manual process or an expensive third party platform that may or may not integrate with their card.

Cardholders have a hard time collecting and keeping track of their receipts and in turn Admins have a hard time getting receipts and GL codes from their cardholders in a timely manner. This means much of the admins time is spent hunting down cardholders for their receipts and expense reports.

“It’s a bit like being everyones mom.”

OUR GOAL

Expense Management Pilot Program

We had a limited feature set that we knew wouldn’t cut it for a live product, but could get us in front of select clients in order to validate our concepts and get additional insights. We decided to partner with 5 clients in order to better understand their current expense management and reconciliation processes, and understand how our features might evolve to provide a solution for our target market.

Pilot Program Initiative

Partnering with our Sales and Relationship Managers, we Identified 5 middle-market clients with 20-50 cardholders to pilot our existing features.

Scheduled In-person onboarding and research visits with 4 of them to help understand more about their current processes and onboard them onto our existing features.

Designed and Developed updates to features to fulfill what we identified as MVP requirements.

Released and tested feature updates with pilot client card admins and cardholders.

A cardholder shows us how he has been using the mobile app.

SUPPORTING RESEARCH

Proxy Research

Empathy interviews with non-Capital One clients had shown that card program administrators would be greatly interested in an expense management feature set offered by their corporate card provider.

Synthesis charts from interviews with proxy users

Market Research

A third party review of banks revealed that no player has successfully combined account management with expense management, showing a potential opportunity.

Competitive review of expense management solutions

Client Segment

This same report, combined with past empathy interviews with card program administrators, helped us narrow down our target client segment to Middle Market clients with a mostly manual expense management process.

Type of expense management solution across company sizes

A card admin walks us through her expense report reconciliation process.

One billing cycle worth of cardholder expense reports.

An Admin manually reconciling a cardholders transactions with their expense report.

Key Insights

1. GL and Expense Codes

There is a need for configurable coding to allow cardholders to code their expenses according to the GL codes of the company. No company codes the same, especially across different industries.

2. Expense Details

Admins need to quickly see the receipt, amount, and vendor name to confirm its a valid charge. They will also confirm that the date the charge was made (as opposed to posted) on a valid business day.

3. Pending Transaction Data

If we were unable to match a pending transaction to a posted on there was no way to move that data over. This was a big problem for restaurant and hotel charges where the amount often changed from pending to posted transaction.

4. Expense Reports?

Admins don’t care if expenses are sent in a report as long as they are getting expense information. Cardholders don’t want to have to come back to submit an expense report, and want to be able to add in expense details and not have to go back to a transaction.

#1. GL and Expense Codes

A “coding cheat sheet” given to each cardholder.

Hand written coding on an expense report.

Problem

Expense codes differ across clients in terms of labeling, structure, and type. Some clients have hard to remember coding rules. One client had cardholders hand write their codes onto a printout of their transactions.

Insights

Labels need to be configurable to have a name that makes sense to their cardholders.

Generally all their codes fit within two categories — a set list of numeric codes with a text label, or a free form entry for cardholder to add in a code or notes.

Codes don’t change very often, but new ones get added often, especially depending on the industry.

Solution

We were able to design and test out designs with our pilot clients to validate our solutions. Clients loved the ease of being able to change code labels if they needed to and not need to contact us or a sales representative. We added Custom Field functionality to the settings page within their account

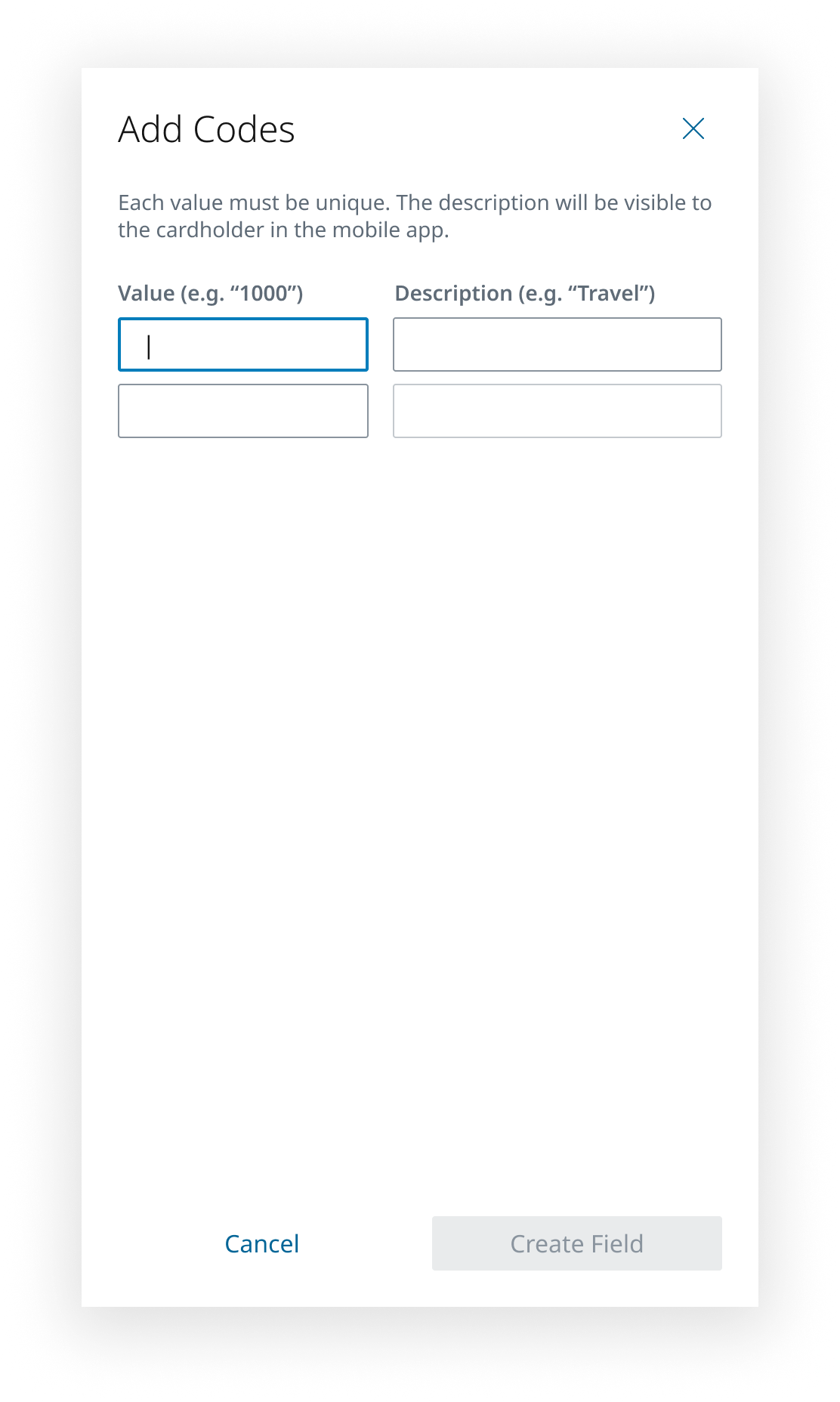

A simple Creation process in a tray experience allowed admins to create a field name, choose a type, and, based on their selection, allow them add in their codes.

As they tab through the fields in the Add Codes panel, more input fields appear.

We determined that clients within our target market only needed up to four fields, so it was limited at that. Admins could change the field name, deactivate the field, or manage the codes if it is a select list.

For lists of codes, each input has a numeric value, and a human-friendly term that appears to the cardholder in the select list on their expense detail pages within the mobile app.

Custom Fields as they would appear to the cardholder within the mobile experience.

#2. Expense Details

Problem

Our existing expense details tray and link to download receipt was just downright annoying for admins. There was too much work involved in just viewing the expense data and having the download the receipt just to view it was not efficient. The tray was not scalable to allow for additional information, or to allow displaying the varying custom fields.

Insights

Admins want(ed)* to bulk download their receipts on a per-statement basis, but just be able to quickly confirm the vendor name, date, and amount when doing their reconciliation.

Transaction details needed to accommodate custom fields and the variety of configurations clients may have, and potentially be editable by the admin in the future.

*We found in our follow meetings with Admins that they no longer felt the need to do this after working with the platform and trusting that their receipt images would be there as long as they were able to access the transaction (7 years of transactions and data are stored in the platform).

To get in front of users faster, our pilot program solution was adding in download links to each transaction for the receipt images. This was the smallest level of effort which allowed us to test out expense management within the platform the fastest.

Solution

We revamped the transactions page to account for the expense details, and things that we had identified as future needs — like an admin being able to edit or enter in expense codes. We created a cleaner slide out panel which displayed the receipt(s) immediately, giving the admins an easy way to quickly compare it to the merchant information at the top. The panel was also flexible enough for whatever custom field configuration a client might have, and could easily grow to accommodate more information if needed.

#3. Pending Transaction Data

The Problem

Pending transactions are actually a totally different transaction from their posted counterparts. To users, it appears that a pending transaction just seamlessly transitions into a posted transaction when really behind the scenes they are two different things. This causes an issue when users are adding expense data to pending transactions within the mobile app.

In those instances, the app would automatically match pending to posted transactions and subsequently move that data over. This works 95% of the time but is especially hard with transactions like restaurant or hotel charges where the pending amount might not match the posted amount. We needed to design a flow that would allow cardholders to do this process manually.

Insights

While talking to cardholders during the pilot, these were how cardholders perceived these issues:

I already added data to this transaction, where did my receipt and codes go?

2. This transaction is appearing twice, why was I charged twice?

Solution

To cover these two main user problems and any edge cases I designed out 4 different experiences that would be present depending on the transaction status.

MISSING EXPENSE DETAILS

We a dded actions on the transaction detail page that allowed cardholders to either “push” or “pull” details from a pending or a posted transaction.

If a user was “Missing Expense Details” or “Seeing Duplicate Transactions” they could select the corresponding transaction to move details from.

DUPLICATE TRANSACTIONS

A very rare occurrence meant that expense details could be on a pending transaction past the 5 day “expiration” period for a pending transaction. In addition to an alert on the homepage, we allowed users to remove the transaction or move the details to the correct posted transaction.

We added a user-triggered removal of a pending transaction before the 5 day period if there were no expense details on it.

#4. Expense Reports

What expense reports?! We removed expense reports entirely from the app. Admins want the information faster, and cardholders don’t want to have to remember to submit a report. Once a cardholder adds their expense details to a transaction, the admin can reconcile it, meaning faster time till reconciliation, fewer missing receipts, and admins can reconcile on their terms, and not get backlogged at the end of every month.

Conclusion

The pilot program was a great way to test out truly minimum features in order to test out a concept with an identified target market. The clients we worked with were so helpful and willing to give insights and feedback on a regular basis which made designing and releasing updates during the pilot easier. Unfortunately, this project wrapped up around the start of Covid-19 when travel and expense spending by companies almost completely went away, and the Expense Management features of the Commercial Card Platform and mobile app were not released to clients outside the pilot clients.

“We are really enjoying the ease of it. Our owners even love it! one question we did have have was, do you know when we would be able to get it for our other companies? It is really making our lives easier so the sooner the better for us.”